Deborah Truong, Head of Customer Experience at Toyota Financial Services (TFS), shared her insights at the latest imagino Breakfast event, organised in partnership with KPC. The goal? To provide feedback on the implementation of the imagino customer engagement platform (CDP and Campaign Management) and its impact on various key performance indicators. The speakers shared their formula for a successful CDP project: an agile and scalable solution, tailored support, and a “use case first” approach.

Here is a recap of an inspiring testimonial to help you take your customer engagement strategy even further in 2025!

Understanding the customer journey: a strategic imperative

With nearly 100% of sales conducted through dealerships, Toyota Financial Services had minimal direct contact with its customers. The result? A weak connection with the brand, limited customer insights, and underutilisation of customer data. In 2021, TFS established a “Customer Experience” department with the primary aim of optimising the customer journey to enhance satisfaction and loyalty. In this context, a CDP project became a strategic priority to unlock customer data and make it available to business teams.

“It was essential for Toyota Financial Services to start by understanding the customer journey, from the beginning to the end of their contract. This was crucial to identifying satisfaction points and pain points in order to implement the right strategy,” explains Deborah Truong, Head of Customer Experience at Toyota Financial Services.

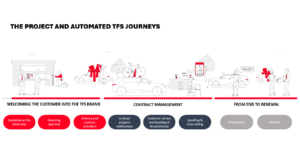

To build a lasting relationship with its customers, TFS focused on key moments in the customer lifecycle: onboarding, payment tracking, contract management, and additional service offers.

In total, four key journeys were implemented with specific objectives:

- Reassure customers and build trust with the brand

- Maintain a strong connection throughout the contract duration

- Prevent potential friction points (such as missed payments)

- Empower customers with self-service options on the website

- Facilitate contract renewal through loyalty offers

“The customer journey at Toyota Financial Services is now fully automated and personalised, thanks to the customer data we have centralised and unified through the imagino CDP. The challenge when implementing such customer journeys is to avoid what I call the ‘corner shop syndrome’; trying to account for every single exception. The complexity lies in simplicity.” says Corinne Bourdin from KPC.

These customer journeys encompass more than 300 campaigns and were implemented in three stages: strategy definition, content creation, and deployment in imagino (which combines both CDP and campaign management in a single platform). The initial use cases were set up within two to three months, but future journeys will be deployed more quickly thanks to the extensive groundwork done on data. This is a ‘game changer’ for marketing teams that previously had no access to customer data.

Leveraging and Enhancing Customer Data

By focusing on customer journeys and business needs, Toyota Financial Services capitalised on key moments in the customer lifecycle and quickly saw results.

“After a few months and tens of thousands of emails sent, we observed highly promising delivery, open, and click rates. Our open rate exceeds 65%, and our response rate ranks among the best in the banking sector.” comments Deborah Truong.

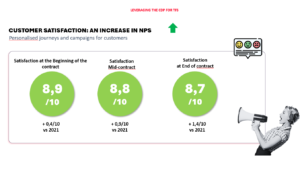

Beyond improving marketing performance, Toyota Financial Services also recorded a significant increase in customer satisfaction, as evidenced by key metrics:

According to Deborah Truong, what stands out most is the correlation between customer satisfaction and loyalty: “Thanks to imagino, we can identify correlation points, allowing us to justify our action plans and measure the impact of this large-scale project on our business.”

A unique aspect of the Toyota Financial Services project was the critical role of the dealership in the customer experience: “At Toyota Financial Services, the dealership remains a priority. Each use case aims to optimise the customer journey while reducing the dealer workload by automating low-value tasks, such as anticipating customer requests.”

The development of customer knowledge has enabled Toyota Financial Services to provide useful insights to dealerships, allowing them to offer a smoother, more personalised experience.

Another major beneficiary of the CDP project was the customer service team. The creation of a unified customer profile enabled them to tailor interactions and gain a clearer understanding of customer satisfaction and engagement levels. How? By aggregating data from multiple sources and generating calculated scores directly in imagino. As a result, call times were reduced by half.

Exploring New Horizons

While the results of Toyota Financial Services CDP implementation have been highly positive three years on, future opportunities are still on the horizon! Thanks to KPC tailored support, the teams have already identified new areas for development and potential use cases:

- Predictive scoring: integrating user behaviour scores to improve message prediction and personalisation.

- New communication channels: exploring additional channels such as push notifications to optimise reach and engagement.

- AI integration: leveraging the latest AI advancements to enhance user experience and deliver better results.

With the imagino tag, Toyota Financial Services has started collecting browsing data and has already tested abandoned cart campaigns; something entirely new for a brand that historically did not engage in eCommerce. Over the past six months, the teams have also developed a journey around maintenance contracts, generating promising revenue figures of 150,000 €. These use cases illustrate new opportunities for the brand to continue optimising its CDP and maximising the value of this project over time.

The agility and scalability of the imagino platform make these future developments possible. Gilles Liguori, Partner at KPC, affirms:

“When we work on a new project in partnership with imagino, we start by creating a data model as the foundation. But this model is not static: it evolves over time. It’s like a ‘mille-feuille pastry’: each use case is an additional layer rather than creating multiple separate models. Every iteration enriches the overall structure.”

About Toyota Financial Services

Toyota Financial Services (TFS) is the financial arm of Toyota and Lexus, offering automotive financing solutions such as loans, lease-purchase agreements, and services related to vehicle financing and maintenance. Present in 38 countries, TFS has been operating in France for 25 years, serving 170,000 customers and financing 47% of new vehicle sales. Working closely with the manufacturer and Toyota network of experts, the teams design diverse and competitive offers to help customers manage their automotive expenses with peace of mind.